What is investment allowance and how to claim?

What is Annual Investment Allowance?

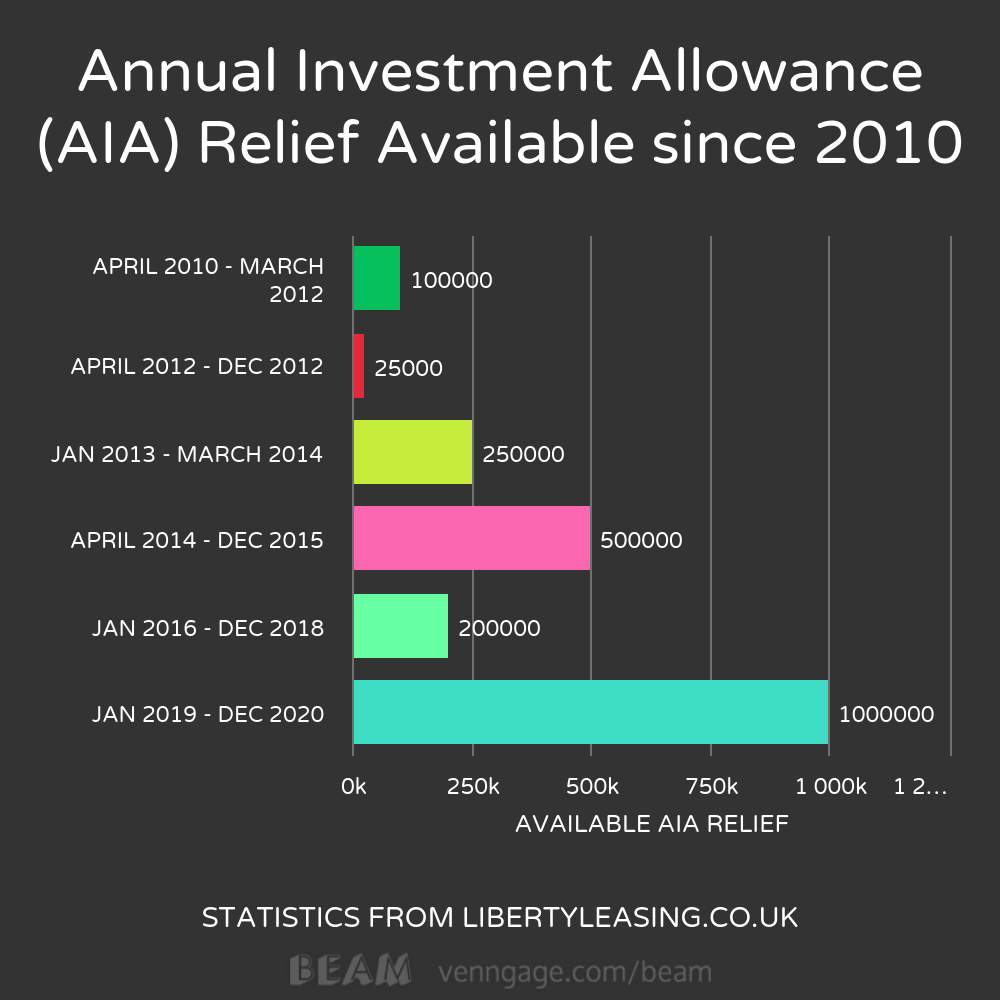

The Annual Investment Allowance (AIA), which was first pioneered in 2008, is a means of claiming tax relief on plant and machinery assets up to £1,000 000 that your business purchases to sustain growth. The ultimate goal of the Government is to increase economic growth.

So, in a move that has been praised by many notable Farming Institutions, the government announced on the 29th of October last year that as of January 1st of this year, the 100% tax relief Annual Investment Allowance was being raised to 1 million, until 2021. That means that for two years, farmers and agricultural business can take advantage of a drastic increase in relief. Until the end of 2018, the allowance was pinned at a maximum £200,000. Overall, though the increase in relief is temporary, it’s certainly a praiseworthy move by the government.

The Annual Investment Allowance (AIA) allows relief on expenditure on machinery and plant purchases, besides building improvements and other assets which are set against farm profits in the year the investment occurs. This will certainly help farmers who may be struggling to cope with the hardships of Brexit and provide an incentive for farmers fearing large capital expenditure for that reason. Capital expenditure qualifying for AIA relief includes plant and machinery, which spans agricultural machinery, as well as ‘integral features’ of a building or structure.

How can I claim Annual Investment Allowance (AIA)?

Obviously, the amount of investment relief farmers can capture very much depends on the timings of accounts year-ends etc, so the most useful thing we can tell you to do is seek professional advice and speak to your accountant, to maximise the improved Annual Investment Allowance.

Here are some useful links to get you started:

Obviously, the amount of investment relief farmers can capture very much depends on the timings of accounts year-ends etc, so the most useful thing we can tell you to do is seek professional advice and speak to your accountant, to maximise the improved Annual Investment Allowance.

Also, when planning how to make use of the new AIA features, it’s wise to factor in delivery times on some machinery purchases. Here, I will remind you that Agri-Linc offer a huge range of Used Machinery as well as New Machinery from stock to save manufacturing waiting times. Brands including Herbst Trailers, Bailey Trailers, a large range of Attachments, as well as our very own PROFORGE® range of cultivation equipment are all available for viewing at our yard or view online.

Purchase wisely – Finance wisely.

Sources/interesting links: